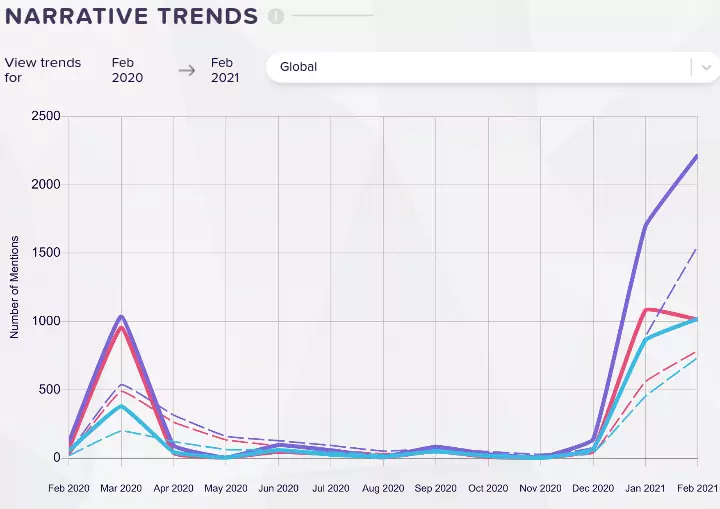

On Jan 23, 2021, 8 PM, our trend bots notified of a surge in chatter related to wallstreetbets, which seemed like a Reddit forum going viral at best. Over the course of the next seven days, as we tracked the volume of chatter exploding across Twitter and Reddit, the added calls from Chamath Pahlipathiya and Elon Musk supporting the “Retail Investor left holding the bag …” narrative gave this whole wave added impetus.

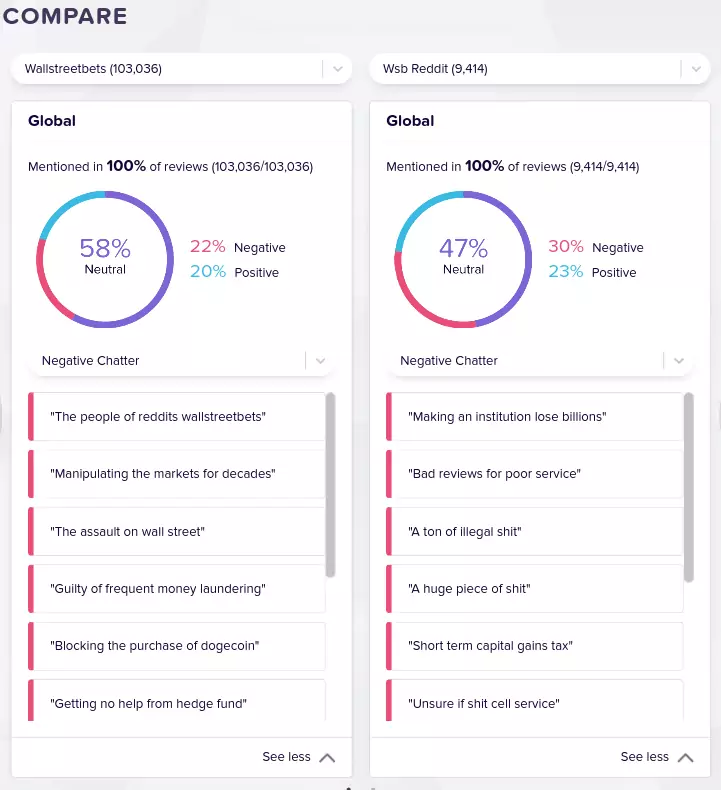

We gathered 150,000 data points from Twitter and Reddit, related to wallstreetbets and the Robinhood app. This continued for eight days from Jan 23, 8 PM to Jan 31, 4 PM. We expected a negative skew but our main curiosity was to identify key entities that are the target of this emotional intensity.

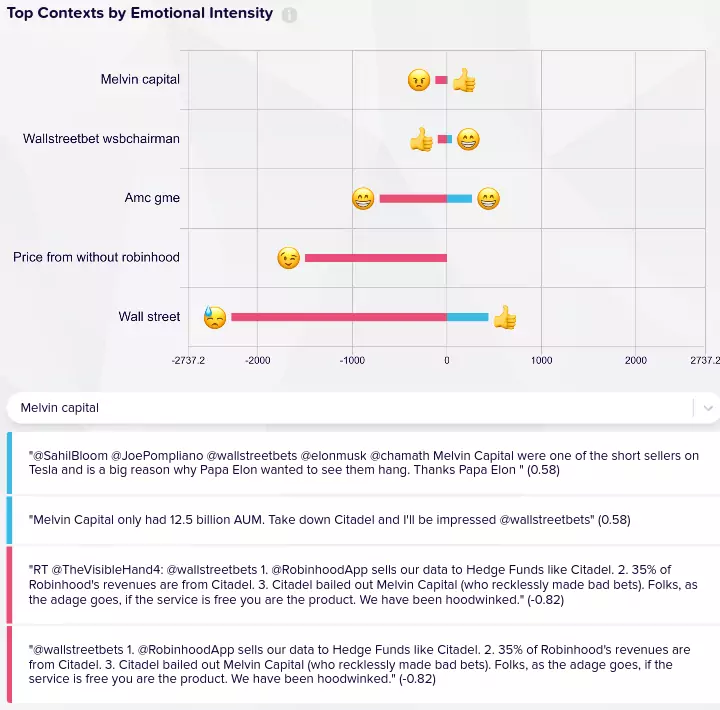

On examining the analysis, the first thing we noticed was a big cluster of negative emotion towards hedge fund context in Twitter chatter. On further digging, this was related to Melvin Capital and Citadel who were also on the losing end of the squeeze trade in motion against the naked short positions held by these and other associated financial and non-financial entities.

Our monitoring of chatter related to r/wallstreetbets did not reveal any other entities outside of GME and AMC with emotional intensity. We will refresh this view in a couple of weeks and who knows that timing may just work with an emerging narrative. This group of over 8 MM members strong at the time of writing this post has shown enormous influence to move the market and price action in their favour.

Entrepreneurial heavyweights like Chamath Palihapitiya, Elon Musk, and Mark Cuban have stood up for WSB and the news coverage is both constant and global. The cherry on top has been the squeeze this group manufactured to create losses for those holding short positions.

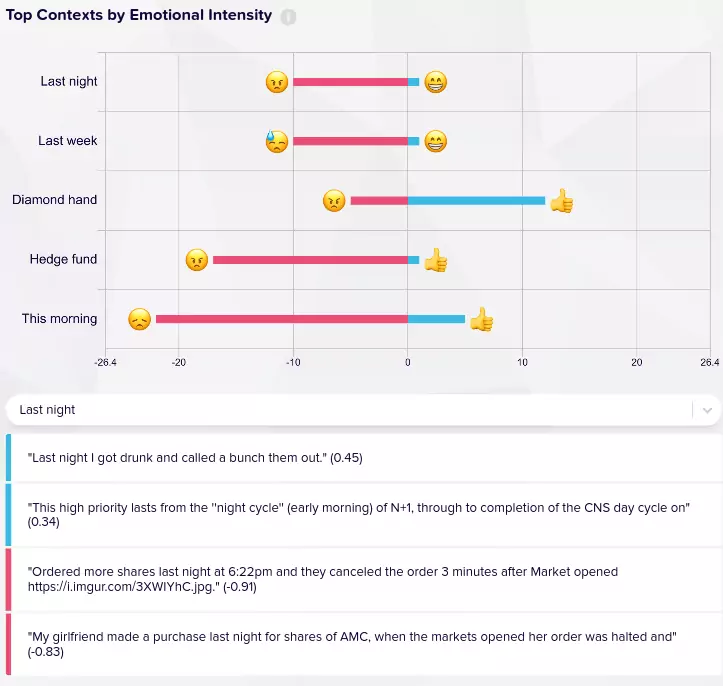

We did notice that Reddit chatter had mentions of language that seems unique to WSB members using phrases like Diamond Hands and Paper Hands. These two terms were also top two emotional contexts with high sentiment intensity.

The related utterances are new to talkAItive but in the first pass we did very well for not knowing what this slang meant from a usage standpoint. On further examination Diamond Hands are considered better at trading than Paper Hands who seem to get out of a trade too soon.

Also, it was interesting to find out that WSB chatter had emotional peaks back in Feb 2020 exactly 1 year before this emotional outburst. At that time the focus was on heavily shorted travel stocks e.g. SPCE. The big difference was the scale and organization which this group got right as part of the Feb 2021 event.

From a human and personal experience perspective we observed chatter outside of the price action and technical jargon which you would expect from the investment bugs. We found a significant number of utterances related to the negative personal experience related to canceled orders due to the abrupt trading halt placed on GME and AMC by Robinhood app. The anticipation of the big move and the major let down when these individuals were simply not allowed to trade was evident as one of the top emotional contexts.

The reason we used Reddit Rebellion as our title is that this event is reported as a rebellion against the established dark trades backed by large hedge funds which artificially suppress asset pricing using exotic instruments not accessible to retail investors. This is the first of its kind, social media charged movement challenging this asymmetry that has long benefited select institutions who have managed to build a network that makes this asymmetry possible.

We will continue to monitor as wallstreetbets shifts its focus to other artificially suppressed assets, their current modus operandi, and that itself could change as the tactics evolve. It is very clear that this Reddit group made a statement and communicated that they will continue to challenge the status quo that allows select parties to benefit from the artificial imbalances.